Loading post...

Message us

Testimonials

For entrepreneurs by entrepreneurs

Ahmed Founder of Oasis Tech Solutions

"Fuluflow has been a game-changer for my small tech business. It's user-friendly and tailored to the UAE market, making VAT compliance a breeze"

90%

of our customers save time, money and are satisfied with Fuluflow.

"Fuluflow has been a lifesaver for our trading business. It's designed with the UAE market in mind, making tax calculations and reporting a breeze. The support team is responsive, ensuring we are always on top of our financial game. Thank you, Fuluflow!"

Fatima Ibrahim

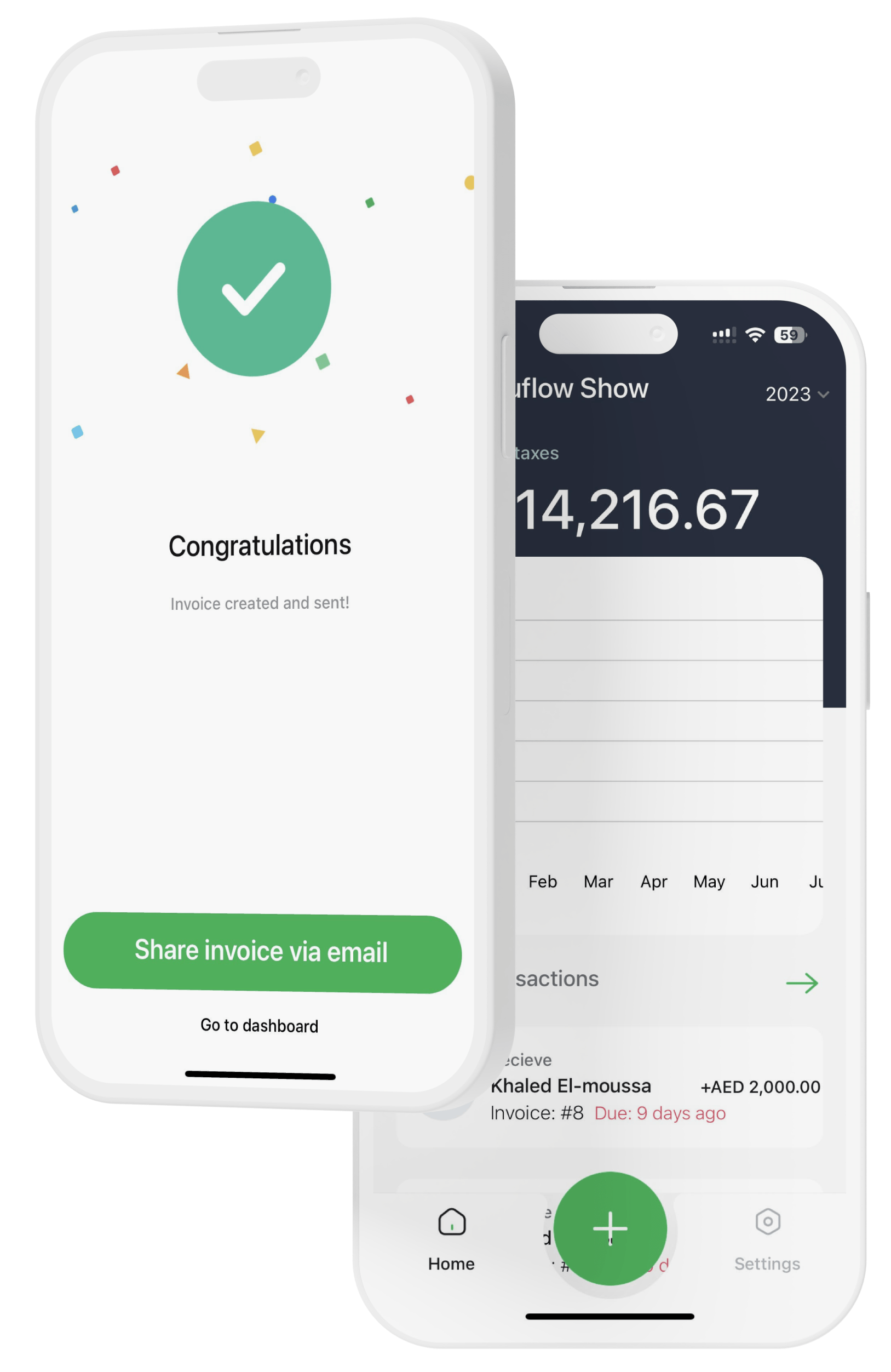

Get your financial dashboard with Fuluflow for free today

LEGAL

© Fuluflow LLC-FZ - 2024